Inside a Will: What the Key Clauses Actually Do

Many people sign their Will without ever really reading it. It’s full of words that sound familiar — “revocation,” “residue,” “executor,” “trustee powers” — but few people could explain what those clauses actually mean or why they’re there.

Every clause in a Will exists for a reason. Some are there to keep the document legally sound. Others reflect lessons learned from real cases where something went wrong. Understanding the structure of a Will helps you see how it protects your wishes - and where mistakes or assumptions can cause problems later.

1. Revoking Earlier Wills

Every new Will starts by cancelling all previous Wills and codicils (a codicil is an add-ons or amendment to the original Will). That single sentence ensures that only your current instructions apply. Since the Wills Act 2007, not having this clause isn't as problematic as it used to be, however, including a clear revocation clause removes any doubt and helps ensure there's only one Will that applies to your estate.

2. Funeral Wishes

A Will can record what you’d prefer to happen to your body and your funeral arrangements, but these are not legally binding. The clause gives guidance, not instructions. It can still be helpful as it tells your executors and family what you’d want if possible. It’s best to also have those conversations in advance, especially if you have specific cultural or faith-based preferences. If you haven’t already prepared an Advance Care Plan, it’s a good companion document to your Will. It records your values, healthcare preferences, and what matters most to you if you can’t communicate those decisions yourself.

3. Whether Your Will Covers Worldwide Assets

A typical Will covers “all my property wherever situated.” That can be useful if you own everything in New Zealand, but if you have overseas property, it can cause issues. Each country has its own succession rules and sometimes its own tax implications. If you own assets abroad, it’s worth checking whether you should have a separate “situs Will” for that country or if forced heirship rules will apply. Otherwise, your NZ Will might be challenged, or it may not meet the foreign legal requirements.

4. Appointing Executors

Executors are the people who take legal responsibility for managing your estate after you die. They apply for probate, deal with your bank and IRD, pay debts and taxes, and distribute your assets. Most Wills appoint two executors in case one can’t act. Think carefully about who to choose. They don’t have to be family members, and in many cases it’s often better to appoint people who have sound financial knowledge, are organised, practical, and, if you have named more than one person to act for you, that they are able to make decisions together.

If an executor dies, declines to act, or becomes incapable, your Will should name a replacement or allow the surviving executor to continue alone. Without a valid executor, your family will have to apply to the High Court for someone to be appointed, which adds delay and expense.

5. Gifts of Cash or Personal Items

You can make specific gifts in your Will. This includes a sum of money, jewellery, furniture, artworks, or other possessions. The law calls these specific legacies. Precision matters. If the item no longer exists when you die or you didn't own it outright to start with, the gift fails (this is called “ademption”). Read about how property ownership affects whether they pass automatically on death or under your Will.

If you want to leave heirlooms or special items, describe them clearly and keep your Will updated as things change. For cash gifts, specify who gets them and whether they’re conditional (for example, “if she survives me”). If they don't survive you then what happens? Does it go to their children (if they have any) or does it fail, in that it is not paid out at all. Executors can’t guess your intentions, so clarity is everything.

6. Loans – Gift or Debt?

If you’ve lent money to a family member or friend, your Will should say whether that loan is to be called in or forgiven. If you don’t deal with it clearly, your executors must treat the loan as a debt owing back to your estate. That can mean asking your children or friends to repay money they assumed would be written off. Not only can it be an uncomfortable position for everyone but it can really cause financial difficulty for them. A properly worded clause can prevent difficulty and/or conflict and ensure all loans and advances are handled as you intended.

And if you have a family trust, what happens if the trustees of that trust owe you money? Should it be forgiven or should it be repaid. With many Kiwi families still using trusts specialised planning and advice can save large sums of money. Especially if a beneficiary is now resident in Australia as every dollar they receive could be subjected to 47% tax!

7. Guardians for Children

If you have children under 18, you can name one or more testamentary guardians. They don’t automatically become the child’s day-to-day caregiver, but they have authority to make important decisions about education, healthcare, and welfare. Appointing guardians gives your family and the Family Court clear direction about who you intended to take responsibility. You can also name a substitute in case your first choice can’t act.

8. The Residue Clause

The residue clause deals with “everything else” left in your estate after debts, taxes, and specific gifts are paid. Without it or by not dealing with your residue correctly, you risk a partial intestacy, which means the law prescribes who will get what could be the largest part of your assets (including a spouse you have separated from but not legally divorced), even if the rest of your Will is valid. Here's what happens if you die without a Will.

Residue is often left to one or more people in set proportions (for example, equally among children). It’s also where you include authority for executors to pay all estate expenses, including funeral, legal, and monumental expenses (headstone or memorial costs). That express reference matters: without it, executors may not have the power to spend estate funds on a headstone.

9. Trustee Powers and the Trusts Act 2019

Many Wills create temporary will trusts — for example, to hold a child’s share until they turn 21. When they do, the executors also act as trustees. Modern Wills include detailed trustee powers to make sure those trustees can act without breaching the Trusts Act 2019. These powers typically cover: dealing with conflicts of interest; paying professional advisers from estate funds; indemnifying trustees who act in good faith; limiting liability for honest mistakes; and allowing investments to be diversified. Without those clauses, trustees might need to apply to the Court for authority to do ordinary tasks, such as selling assets or reimbursing costs.

10. Will Trusts for Minors

If your Will leaves money to someone under a certain age, their share is usually held on trust until they reach that age. The trustees can use income or capital from that trust for education, health, or welfare until the beneficiary becomes entitled to the full amount. This is an important safeguard — it ensures that young beneficiaries don’t inherit significant funds before they’re ready to manage them, while still allowing flexibility for support when needed.

Why Detail Matters

Most Wills follow a familiar pattern, but the detail makes the difference. The slightest oversight or misunderstanding can be the difference between your executors dealing with simple estate administration or years of correspondence with beneficiaries, family members and their lawyers.

Every Will should be drafted around the people who will be affected, your assets, and your plans. And although you could use a template or a Will-drafting handbook (which lawyers often use to guide them on more challenging clause options), this is best done as a starting point. Getting your Will right depends entirely on your situation and could save your loved ones significant amounts of money that you intended for them to enjoy, not be paid towards unnecessary legal fees or taxes.

If you already have a Will, it’s worth reading it again with these clauses in mind. Ask yourself: Does it name the right executors? Does it deal clearly with any loans or business interests? Does it still make sense for how your assets are owned now? Small changes can save your family a great deal of time, stress, and expense later. And while you’re reviewing your estate documents, it’s also a good opportunity to make sure your Enduring Powers of Attorney are current, as well as your Advance Care Plan.

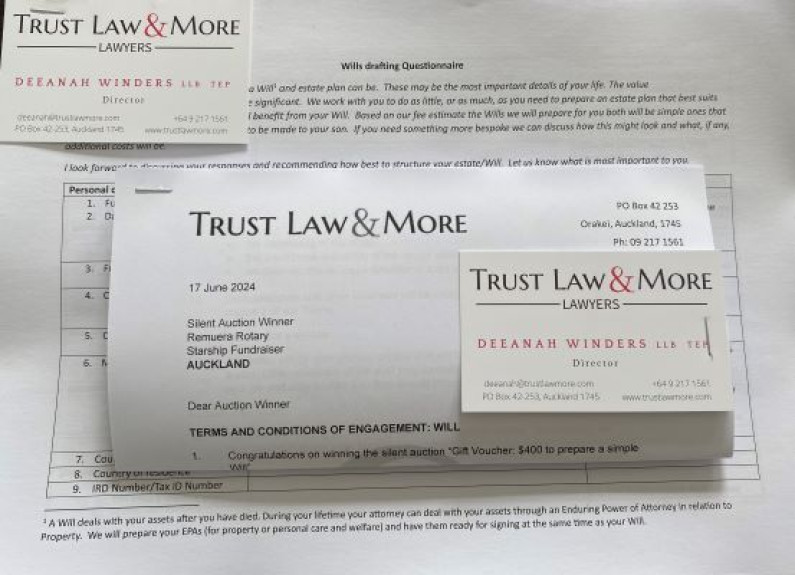

If you’d like to review your existing Will or understand what each clause means in your situation, we can walk through it with you. You can get the ball rolling by asking us to send to you our Wills Questionnaire. Once you've completed and returned it to us we can start advising you on what the costs look like and how complex your situation is. What makes a Will Simple or Complex.